I often hear that Cardano lacks a strong narrative in this cycle. However, Cardano is a mission-driven project that doesn’t need new narratives. Its mission remains steadfast: to become a global financial and social operating system. This mission is being gradually realized. People can be impatient and may have expected quicker progress. They might not understand that blockchain is a disruptive technology, and high adoption can’t be expected in the first 10 to 20 years. Let’s stay true to the project’s mission and the principles of decentralization. This will lead us to success.

Fundamentals Are More Important Than Narratives

New narratives, whatever they may be, only work in the short term. When NFTs are popular, everyone wants their favorite blockchain to be the top NFT platform. If meme coins are trending, the goal shifts to being the best minting platform with high TPS. In this bull run, it’s no longer trendy to build a new DEX or lending platform. Why not just create a new L2 and promise users the much-desired airdrop? Actually, I thought investors were focusing on DePIN projects.

But what happens when the bull run ends? Most people won’t care, as they might not stick around for the next long and challenging bear market that many crypto projects won’t survive. No worries, we’ll just come up with new narratives for the next cycle.

Cardano doesn’t need new narratives. It’s a mission-driven project with a clear goal: to become a global decentralized financial and social operating system. This is the core narrative of the project. Isn’t that enough?

To achieve this, the project must meet several key criteria. First, it must be decentralized, ensuring that DeFi is secure for users. Second, it must be capable of evolution, meaning it needs to be economically sustainable in the long term. This includes not only the fees collected but also decentralized governance and funding for research and development.

Reaching this goal requires a sustained effort from both the team and the community. It’s not something that can be achieved in just one or two bull cycles, which are to some extent artificial events caused by the Bitcoin halving.

I understand that there are narrative investors in crypto, but they might just be short-term speculators. True investors focus on the fundamentals and future potential of a project. In the crypto industry, it’s often not just about investors, but about people who value decentralization and see blockchain as a chance to transform society. While for many, the crypto industry may seem like pure speculation, true success is tied to the adoption and use of decentralization principles.

In the early years of Bitcoin, there was concern that people wouldn’t embrace decentralization or would be wary of self-custody wallets. Over time, these fears have been somewhat validated, as many people use centralized L2s or custody services.

Does this mean blockchain has failed? Perhaps it simply means that the adoption of decentralized services will take more time.

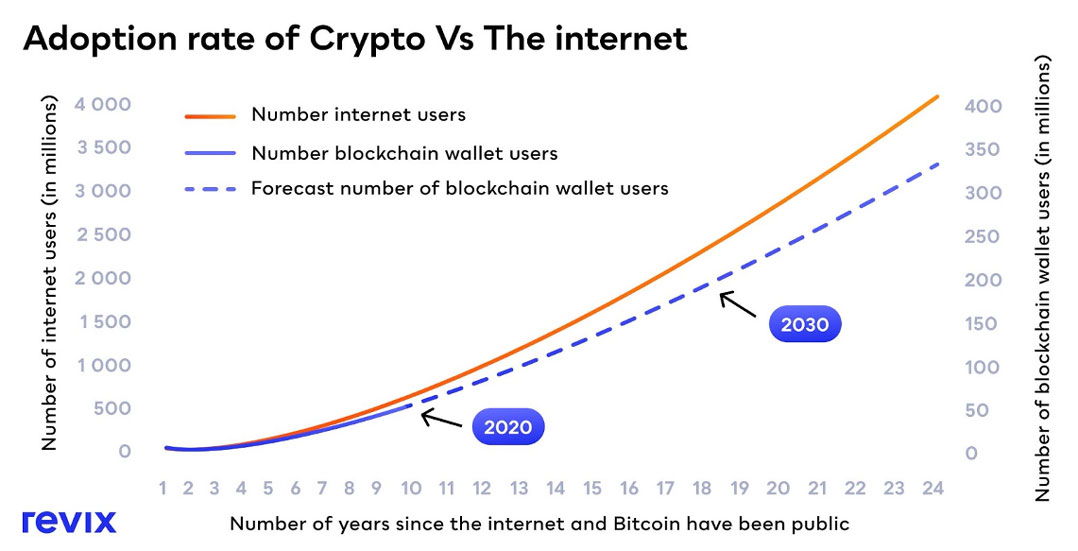

You often see comparisons between the speed of internet adoption and blockchain adoption. At first glance, blockchain adoption seems to be progressing at a similar rate to internet adoption, which sounds promising. But there’s a catch.

These comparisons have a flaw. They count all blockchain wallet users, including those who hold crypto on exchanges. The number of people using self-custody wallets is only in the lower tens of millions. If we consider a true blockchain user to be someone with a self-custody wallet, then the pace of blockchain adoption is actually 10 times slower than that of internet adoption.

What does this mean? It means we’re still in the early stages of blockchain adoption. Most people are holders, not active users. The blockchain industry lacks a direct network effect, which is a challenge for all blockchain projects, not just Cardano.

While some argue that hodling counts as usage, it’s important to understand that no blockchain can be economically sustainable without a direct network effect, meaning without transaction fees.

The lack of active users is an issue for Cardano, as well as for many other blockchains.

Can this problem be solved with a short-term narrative for one bull cycle? Certainly not.

Can decentralization be replaced by a centralized network or a collection of L2s? Fundamentally, no, because centralization inevitably leads to the abuse of power by intermediaries.

The only solution is to continue building a global decentralized operating system that will eventually be adopted by millions of people.

Who Will Be The Winner?

People naturally gravitate towards the best available technology. While this might not always be the most decentralized option, decentralization will still play a crucial role. Users will seek the best overall experience, which includes not just TPS, but also security, user interface, available services, fees, and more.

When it comes to adoption, there is no clear winner among blockchains yet. Projects with higher market capitalizations don’t necessarily reflect superior technology. The market often experiences inertia and manipulation.

Projects you’ve never heard of can easily make it into the top 10, often due to manipulation or short-term narratives. Whales anticipate bull markets and try to capitalize on them.

Ultimately, winners will be determined based on the network effect, which must last several years. No project has achieved this yet. When bear markets hit, users tend to leave. So far, there is no definitive winner.

I somewhat agree that Cardano as a platform will face challenges if the market value of ADA doesn’t thrive. However, there’s no simple solution if we want to avoid the market manipulation seen with other projects. Does it make sense to artificially pump liquidity or use bots to create unnecessary transactions to make the network appear more active? Or is it easier to inflate the market value of ADA, because people often believe that if the numbers go up, the project must be good?

I don’t know the right solution. However, I believe the best approach is to continue building and adhering to the principles of decentralization. Cardano doesn’t need to compete with other projects in terms of market capitalization. The goal is to deliver quality technology. Market capitalization should be justified by superior technology. I do not believe that false narratives can determine the winner.

Influencers might say that market capitalization reflects the interest and quality of a project. However, this is true for technologies with high adoption rates. As mentioned earlier, blockchain adoption is still in its infancy.

When blockchains have long-term full blocks, it will become clear which ones can best handle the influx of users. So, perhaps the best course of action is to ignore the noise and keep building.

We don’t need to worry about Cardano not being attractive to investors right now. They will come when they see a strong network effect. Our long-term goal should be to attract users. Delivering Ouroboros Leios and tighter Hydra integration are essential steps.

Users will seek utilities, which can only be built if they are financed. ADA in the treasury might not be sufficient to fund projects and build the necessary infrastructure. Cardano should appeal to VC investors. Explaining the benefits of Cardano to VC investors should be one of our short-term goals. The Cardano Foundation and Emurgo have become more active in this area, which is gratifying.

Conclusion

We all know that on-chain governance is essential for a decentralized project. However, some argue that it isn’t attractive enough for users or investors. The reality is that many people don’t fully understand the concept of decentralization. Let’s not expect them to grasp the significance of on-chain governance right away. Most of the approximately 600 million crypto holders keep their assets on exchanges. Don’t expect them to engage in governance.

Non-functioning governance negatively impacts the blockchain. It’s often said that both Bitcoin and Ethereum are captured. Teams may deliberately avoid improving L1 scaling because they are well-compensated to support the L2 ecosystem. Bitcoin’s centralization issues are not addressed. The ultra-sound money narrative has faltered, especially with inflation rising again after the introduction of BLOB transactions.

I don’t want to focus on the problems of other projects. Instead, I want to emphasize the importance of decentralized governance in the long term. It’s crucial to learn from the mistakes of older projects.

It’s often said that Cardano’s development is slow, but that’s subjective. Cardano has liquid staking, which many, including Ethereum, are trying to copy. It’s also highly decentralized compared to other top 10 projects. Cardano has never needed a network restart and has survived a DDoS attack. While its DeFi ecosystem has less liquidity than some others, it has never experienced a major hack or wallet drain.

Scaling via L2s is increasingly problematic and can’t be the sole solution. L1 scalability is essential for all blockchains. DOOM on Hydra demonstrated 7000 TPS. After the Chang hard fork, Cardano will incorporate ZK cryptography, enabling the creation of ZK Rollups. Cardano will soon scale effectively on both L1 and L2.

To some extent, TPS is just a narrative in this bull market. High TPS is crucial for success because it’s necessary for achieving a high network effect. However, it’s not essential to have high TPS immediately when user demand is still growing.

It’s crucial to achieve high TPS without compromising decentralization. Scalability must be attained without the need for frequent network restarts. This is the long-term goal for the entire crypto industry.

I believe Cardano is fundamentally doing very well, and the best path to success is to keep building. In a bull market, influencers often push narratives because they are paid by L1 or DeFi teams. It’s certainly valuable to observe how users think about and interact with blockchain. However, focusing on short-term narratives is not very productive. It’s crucial to attract users based on strong fundamentals, as this will ensure they stay. Narratives come and go, but users attracted by solid fundamentals are more likely to stay.