The last few months brought stable progress and the product and customer-base are developing within expectations.

Our current strategic focus is to create meaningful and defensible differentiators for the project.

We have identified Content, Community, and Retention Rate as the main drivers of differentiation.

Content

Positioning the platform with a focus on audiovisual content that is highly engaging but also insightful was the right choice.

We observed that the velocity of content fits the required depth of information well.

Our content sits well in the middle between Twitter / Stocktwits (where comment and content merge) and Motley Fool / Seeking Alpha / Blogo-sphere where a deep analysis is provided.

Twitter’s content velocity is too high thus not allowing a real engagement with the content. Deep analytical content, however, is quickly outdated in markets with high volatility.

Users gave positive feedback that being able to quickly glance the gist of the post and then use the “Insights” feature to drill down further is a game changer for their content research.

We further executed content partnerships with WSJ, CNBC, Fox Business underlining the effectiveness of short-form visual content.

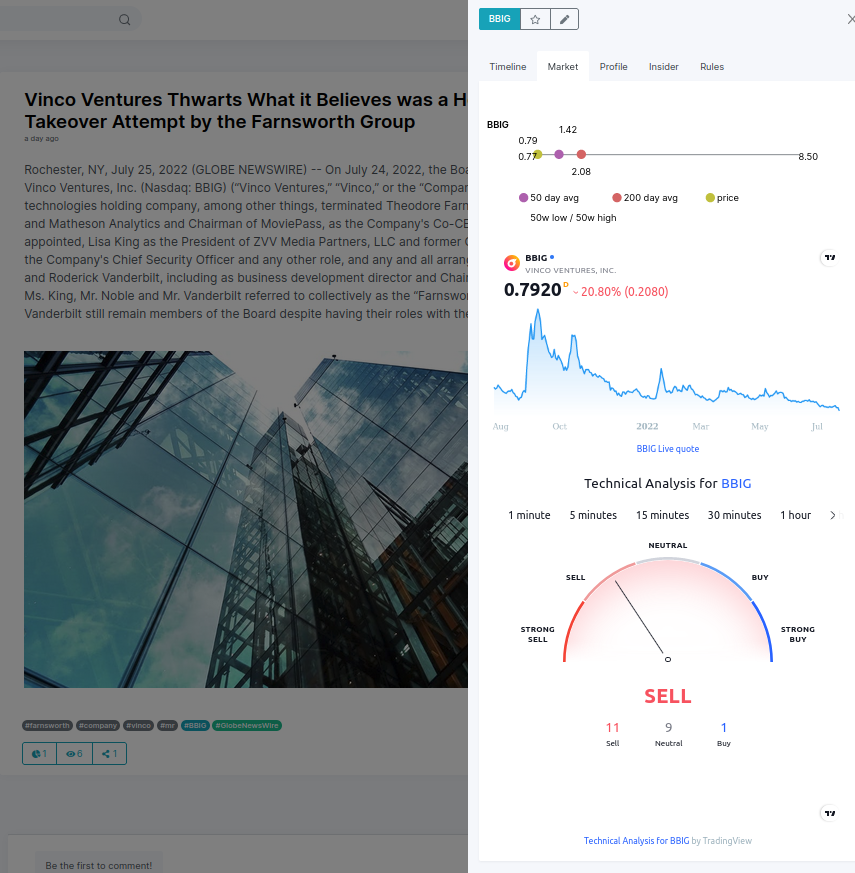

Examples:

[Yahoo] https://app.finclout.io/t/xJoqNNl

[CNBC] https://app.finclout.io/t/4xn0X18

Automated social listening tools from hyperfocus.ai are operating stable and provide a solid basis of relevant, personalized, and AI-enhanced information.

Community

The current focus on onboarding smaller writers, creators, and analysts works well. The learnings are promising and lead unsurprisingly to further improvements in the product quality.

For example, we have brought the search function to the main /home page giving creators an easy way to find content for their search term.

Further information about how the UX has evolved can be found here: https://medium.com/@finclout/the-evolution-of-our-home-screen-701ef8fbdeec

I further learned more about my users workflow. Once they have decided on (or given) a topic most are using (1) Google (90%), (2) Youtube (45%), and interestingly few use the company’s own website (~5%) for researching their article. All creators also mentioned that they augment their research through skimming news articles and various social channels to identify who is also talking about this content cue, and why.

All mentioned that the finclout app does solve their current research needs.

This feedback is reflected in increased app usage.

As now a relevant size of creators operates on the platform, we have transitioned away from team-to-user interaction to further encourage user-to-user communication. Therefore, we moved from RocketChat to internally developed Notifications and Messaging. The cost-per-seat of RocketChat was too high and the internal implementation will give us more flexibility for introducing the premium subscription NFTs-based messaging tier.

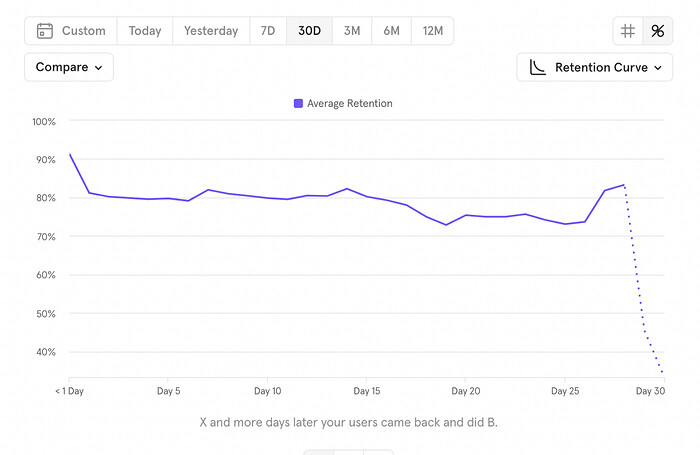

Retention rate

The operational focus on managing retention rate at this stage of the product made sense and had the intended effect on the recent cohort of new users (Retention rate stable at 80% after 1 week).

One of the drivers of this is the implementation of ‘actual proof of work’ which measures user behavior on the app and provides effective monetary incentivization. Users earn Cardano (soon Solana and Etherum) by moderating and curating posts for and from other users. The unique twist is that the moderators are also content creators who are searching for this type of information. Decentralized moderation is scalable. This provides an ideal targeting environment where content recipient and content writer are incentivized to be aligned.

While this increases CAC, the costs are covered through stakepool rewards (Red Bike Asia) & mining activities, as defined by the business model. This revenue is providing us with favorable unit economics for customer acquisition and allows for scalable growth as the user->staking->rewards flywheel is turning.

As seen above, the bear market has only increased the need for our information services, while trading services and exchanges are suffering from reduced trading activities and scammy projects.

We have also launched a premium plan with payments partner Stripe to further differentiate our users and their needs and provide another channel for the company to earn.

(https://app.finclout.io/pricing)

Onwards and upwards.