Decentralization

A plethora of individuals has become fond of blockchain technology, mainly owing to the ‘decentralization aspect’ as it enables anybody to conduct transactions with other individuals, anywhere in the world, with no entity wielding power that can be used to block these transactions or enforce censorship.

Now, try to guess how many times did Satoshi Nakamoto mention the term ‘decentralization’ in the Bitcoin white paper? As a matter of fact, not even once. As it turns out, the concept of ‘decentralization’ does not merely revolve around transactions. Therefore, let’s consider the following definition:

A decentralized system is a kind of system that requires the users to make their own, individual, decisions. In such systems, there is no designated central authority making decisions in the name of all participants. Instead, each participant, also known as ‘peer,’ makes their own autonomous decisions pursuing their own self-interest that may collide with the goals of other peers. The participants directly interact with each other, share information, or, offer services to others. In an open, decentralized system, there are no limits or regulations for new users to access it. Likewise, any new participant can enter or leave the system at will.

We sincerely believe that one of the projects that offer the potential to operationalize the proven concept of decentralization is Cardano .

What happens when the project is decentralized wrongly?

When Satoshi Nakamoto discusses the term ‘transactions’, he explicitly refers to peer-to-peer transactions, in other words, transactions that take place between two specific users, without an intermediary. The role of an intermediary is, therefore, represented, by a protocol, which defines the transaction criteria. Applying this perspective, the word “trusted” is far more appropriate than ‘trustless’.

Pure Peer-to-Peer exchange without the third party.

When authorizing a transaction, one ought to trust that the code is flawless, without any security loophole that would, which would, eventually, enable ‘miners’ to ‘harvest’ the transaction. Subsequently, this premise is intrinsically linked with the presumption of Bitcoin preserving its value in foreseeable future, though there are, admittedly, other elements to be considered, as well.

The presupposition of trusting no one is, however, entirely illogical and irrelevant for the Cardano project as the very faith is put into the protocol itself and, accordingly, the very team behind it.

However, make no mistake. While, from the technical perspective, realizing transactions could be deemed a decentralized operation, standalone, this assertion, will not suffice. As the aforementioned definition of the ‘decentralization concept’ stipulates, the essential notion of it lies in surrendering ‘control centers’ on all levels , not merely the transactional one, as that would be an extremely limited point of view.

Indeed, the real implication of decentralization is far more compelling. It boasts a paradigm-shifting potential as it embodies a power ‘to be reckoned with’ in terms of its holistic impact on the Internet in its entirety as well as the Network’s future development. Individuals who tend to underestimate, diminish or even ridicule the potential magnitude of this phenomenon and the subsequent implications, are very likely to be gravely mistaken.

Ever since 2013, people put forward the notion that increasing hash-rate does not make Bitcoin necessarily safer, as it leads to a higher degree of mining centralization. Individuals were effectively rendered unable to mine cryptocurrencies on their personal computers, and, from the contemporary perspective, it is but a question of time when mining would cease to be profitable on inexpensive ASIC devices, too. This leads to a question, whether it is deemed reasonable to change hash-rate function ever so often.

Likewise, if you are of an opinion that Bitcoin cannot censor transaction, you are wrong. As of now, the blocks are solely designed by mining pools and respective individual miners simply provide their hash-rate and mine a block suggested by the pool, they belong to. Therefore, Bitcoin is no longer PoW, but rather Delegated PoW (DPoW). If the pools ever felt the necessity to exclude any transaction for any given reason (e.g. China-United States trade war) or, on the contrary, decided to include other transactions for the sake of the pool’s benefit, it can be done rather easily. At this point, it shall be noted that the vast majority of mining pools are owned by the Chinese and that there are no more than 10 mining pools of significant importance, a fact supporting the risk argument.

Bitcoin pools in 2019

Conversely, Cardano presents a novel concept of equally large mining pools with unique economic incentives, such as that individuals who submit their coins to a particular pool, earn more if they opt for a pool that is not the largest. In other words, their earnings are going to be larger if they choose a small or mid-size pool.

Consequently, the emergence of a single dominant pool or a pool oligarchy scenario is effectively ruled out. Moreover, thanks to a larger number of mining pools, efforts to block or censor transactions are futile a virtually meaningless. For example, had any Chinese pool attempted such an undertaking, it would quickly be confronted by a European pool with vastly different interests.

In addition, PoW poses a considerable disadvantage in comparison to PoS, as it is heavily dependent on electricity. For that reason, the mining operations tend to be centralized to geographic regions with inexpensive electricity, China being of one such country. On the other hand, PoS has no such deficit as the costs of running a mining pool as well as security costs are similar all around the world, hence another argument for decentralization.

Also, in Bitcoin mining, it has been observed that, due to an increasing hash-rate, it is possible to produce new blocks faster than after designated 10 minute long periods. Consequently, this contravenes the inflation curve designed by Satoshi. Despite the fact that the solution would be relatively simple, that is, to increase the frequency of changing mining difficulty, the current state of affairs is beneficial to the miners, thus no change is sought after.

Sadly, this hardly presents a benefit to the whole community, especially when aiming to increase the global perception of Bitcoin and its mainstream adoption. Wider adoption of any cryptocurrency requires a longer period of time, a notion, that would, opposite to the current trend, call for deceleration of block production, rather than its acceleration.

All in all, Bitcoin suffers from a vast array of abovementioned issues and, unfortunately, none of those has been addressed by its developers for the past 6 years. This can be attributed to the fact that project management is not decentralized, and the participants are divided into several groups, with asymmetric rights as well as diverging interests.

Firstly, there are coin holders, who have literally ‘zero decision-making authority’. Secondly, there are mining pool operators, who profit from the hash-rate at their disposal. Lastly, there are miners, who need mining pools in order to operate and since their aim is to maximize profit, they choose ‘their’ pool accordingly.

This ‘state of affairs’ effectively leads to a situation, in which coin holders have virtually no influence and everything is directed by the team of developers and the mining pool operators, who naturally selfishly prioritize their own goals and have a vested interest to keep the current status quo as long as possible, having little to no regards to coin holders, despite them being deemed a community.

Having said that, the underlying philosophy as well as practical mechanisms of Cardano , are fundamentally different.

First of all, there are only two user groups — owners of equally large pools and coin holders, who are, contrary to Bitcoin coin holders, project stakeholders as well.

Therefore, as ADA token holders, not only will you have a vested interested in keeping up the protocol safety, but at the same time, you will be granted voting rights to actively participate in further project development.

The embracement of these key principles will prevent grim prospects, such as turning a blind eye to the project defects for 6 years since they benefit the privileged minority. As the vote of the majority will be the single force to steer the project forward, the risks from the side of ‘influential’ entities will be greatly decreased.

Imagine, if there was a network that would become the global backbone of the world economy. What would happen? To the rich and the powerful, monetary wealth is simply not enough as they have an abundance of it and so, in terms of motivation, they primarily care about preserving their influence and further fortifying their power amidst the turbulent changes of the new millennium. If there was a project that would be used by, for example, 60 percent of the population, its importance would be astronomical, leading to an increased motivation of the governments, banks and wealthy individuals to seize control of it.

Global financial blockchain backbone

In the foreseeable future, we assert that the magnitude of ‘real decentralization’ would grow linearly with the perceived importance of the given project.

Thus, there is a question, is PoW or PoS more conducive to make decentralization real? If you want to make a change under PoW, decision-making power is determined by hash-rate. If somebody possesses a large amount of fiat (e.g. governments and banks combined) with the aim to make a change, they will create a client, and, during the voting process, connect a new hash-rate, which may play a key role to make the desired change happen.

Obviously, it may prove difficult to convince important mining pools and their mining halls to cooperate. Therefore, a change, unfavorable for the community may be accepted. In this respect, PoW offers a massive advantage for affluent powerhouses because of the hash-rate voting principle, as such a process can be easily influenced by large reserves of fiat.

On the other hand, PoS offers an opportunity to build a system in which the decision-making process, as well as the future direction of the project, will be decided by coin owners, where the number of coins determines the power of the vote. In theory, it is far more difficult to buy out a notable number of coins than to obtain high hash-rate. With the growing value of coins and vast distribution of them within many individuals, it would be increasingly more difficult to secure a ‘decision-making’ voting power.

This is due to the fact, that when purchasing hash-rate, the only important variable is how much time is needed to attain a desirable change, so one only has to consider the time-limit after which a specific chain will be proclaimed ‘victorious.’ Conversely, when buying out a large number of coins, their value is likely to rise exponentially and is hard to be estimated in advance.

The larger the distribution of coins between individuals is, the higher the rate of adoption. Likewise, the rate of adoption will also be accelerated by the ever-increasing utility of the protocol itself. And, with the growing influence of the project comes natural growth in the democratic division of powers. Consequently, not only will ADA play a vital role in the area of security, but also in the democratic management of the project.

If you think about the meaning behind the existence of Bitcoin, arguably, its utility primarily lies in its growing value as well as price volatility, making Bitcoin a great asset for market speculations.

As a currency, the project has failed because of its volatility and current scarcity. Afterward, the narrative was switched from a novel global currency to more of a ‘digital gold’ which makes perfect sense as a deflationary asset can hardly assume a role of currency.

Likewise, digital currency demands stability, which of course does not necessarily mean ‘stability due to being backed by a fiat currency’. The desired direction has been shown by smart contracts and the MakerDao project.

On the contrary, people seldom think of utility or real-life applicability when it comes to Bitcoin; the only criterion to be considered is the price, which is sensible as Bitcoin does not have any real-world application unless we would say that price growth qualifies as one.

Growing price, however, is not a utility feature, if Bitcoin ever truly becomes ‘the digital gold’, it would be associated with its value. ADA does not have the ambition to defeat Bitcoin and claim its place here because not only can ADA be valuable because of its price, but also because its value is fundamentally based on its real-world applicability.

Additionally, its key role in protocol safety when building new blocks and its democratic management is noteworthy. If there would be a protocol utilized by a significant portion of the world with a need for a native currency to control it, ADA will have become scarce.

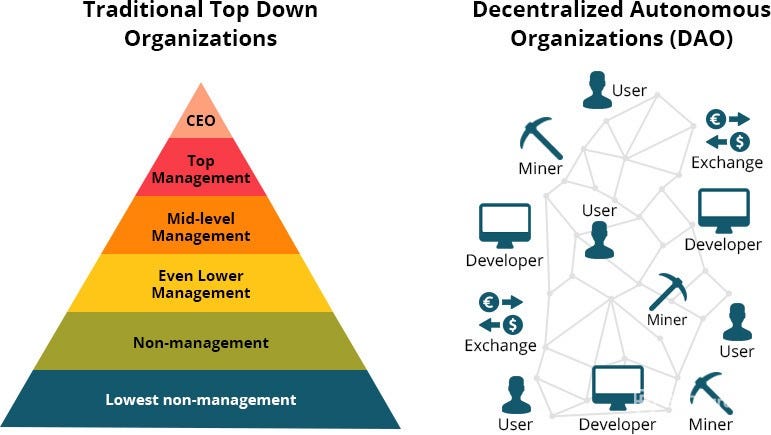

The future lies in decentralized autonomous operations

In order for the blockchain project to reach maturity, its management has to be handed over to the community in its entirety. This means that the community has to have a chance to pinpoint problems as well as assert its rights. The question is — who is the community? In an ideal world, everyone should share the same interests, with both coin holders and mining pool operators being on the same boat, with an implemented mechanism to democratically resolve any issue, should they emerge. This can be achieved by the mechanism of decentralized voting that must be a core element of the project.

How DAO could work

DAO should incorporate digitally valuable assets, which can be used as an instrument to reward individuals for their work within the ecosystem. ADA presents a perfect choice for this. Naturally, the developers have to implement new features, correct errors and enforce necessary regulations.

Vanilla version of DAO should function autonomously, using artificial intelligence. However, such a goal is unattainable at the moment and, arguably, also unnecessary. In a democracy, most individuals opt for what benefits them the most and so, is likely the best option for the whole, too. Therefore, the mechanism of decentralized voting within the community can very well substitute AI due to its democratic nature.

By holding ADA, you are effectively becoming a project stakeholder as well as a part of DAO. Thanks to staking coins in favor of the pool, you are being rewarded for partaking in improving security.

In addition, after a certain period of time, you also get voting rights. Specifically, this moment occurs during the development phase called ‘Voltaire’, a phase when the protocol will have been prepared for complete decentralization and could be handed over to the community. We sincerely believe that no modern project can be successful without some form of DAO.

Conclusion

Whilst we fully acknowledge Bitcoin and its contributions to the development of the whole crypto world, we are convinced that another step in the development of protocols is of vital importance, proved by the fact that an existence of a single dominant decentralized project could be deemed a ‘centralization’ on its own.

Cardano is built upon rigorous scientific research and adheres to formalized methodology in terms of the project development. Because of this, not only can Cardano bring valuable insights to the whole crypto community, but it does also harbor vast potential to captivate individuals, who have not yet been members of the crypto community.

Crypto-related projects can only be successful if their adoption reaches a certain momentum, and thus, new users are extremely important. Conversely, if a larger adoption does not occur, the projects would lose their prospects of real-world applications. And, needless, to say, the value transference feature does not suffice.

Therefore, other elements of crypto projects, such as support for smart contracts, transaction context, the right degree of privacy in different jurisdictions, as well as features such as ‘Atala’ that allows linking to current financial systems makes Cardano a project that is viable for mass adoption and utilization.

Finally, once ‘Shelley’ is launched, Cardano will become a hundred times more decentralized than Bitcoin and we firmly believe that in the following years, Cardano will keep setting the trends in the crypto community as well as the very direction, the crypto world will be gearing towards.

Consider staking your ADA coins with Cardanians.io

If you like our articles, you can support us with some donation:

[ADA] DdzFFzCqrhseNP1C9XEs1MA82rgnVZwNpeiNCbLxrJfRzwaceXB9VYqPFYyRrYegc67SERjcQ1xvwB6jryp5vgGUf1cvzbeZP2a92tQe