Where do transaction fees go? I gather they are not used to pay stake rewards but what does happen to them?

Read the article, I want to offer my thoughts on it. I will take a contrary position, to turn it into a discussion, a debate, an argument. It will be interesting that way.

The first half of the article refers to inflation in POS protocols, how you either keep what you have or lose value over time.

I negate this by adding a dimension to the authors example…

“For a concrete example, take a fictional coin called PIE. The staking rewards on PIE are 10% per year. At the beginning of the year, there are 100 coins in total, and 10 holders, each holding 10 coins. Let’s say half the holders stake their coins for one year, while the other half do not. At the end of a year, each of the stakers will have earned an additional coin, giving 5 stagers with 11 coins each and 5 non-stakers still with 10 each. The total supply has been inflated by 5% to 105 total coins. Each staker, who previously owned 10% of the PIE, now owns 11/105 = 10.47% of the PIE. Each non-staker has at the same time had his stake reduced to 10/105 = 9.52% of the PIE. Note that while the stakers were earning a 10% nominal yield, their real return was a more modest 4.7%, balanced precisely by the losses in ownership of the non-stakers.”

…say at the time of staking this fictional coin was worth $1, then the main net hit/ some progress was made and now the coin is worth $5  The above example gets negated due to an added dimension. The author thinks of profit in terms of coins and not in relation to FIAT. Stakeholders will come out ahead. There is incentive to stake. Remember although POS or POW for that matter creates inflation, cryptocurrencies are deflationary by nature…all coins will eventually be minted and there won’t be a single coin above a set limit. One more thing, this entire article could have just as well been about POW. There’s no discernible distinction made here, this article does not support in any way the statement “Why Uncle Sam loves Proof of Stake.”

The above example gets negated due to an added dimension. The author thinks of profit in terms of coins and not in relation to FIAT. Stakeholders will come out ahead. There is incentive to stake. Remember although POS or POW for that matter creates inflation, cryptocurrencies are deflationary by nature…all coins will eventually be minted and there won’t be a single coin above a set limit. One more thing, this entire article could have just as well been about POW. There’s no discernible distinction made here, this article does not support in any way the statement “Why Uncle Sam loves Proof of Stake.”

The second part of the article is about taxes, and I sigh as I read this;

Assume, for sake of simplicity, that all PIE-holders are US taxpayers paying a 35% marginal tax rate, and of course , pay all their taxes. Since everyone is staking, and they’re getting paid 10% nominal yield, they will owe 3.5% of the initial market cap in taxes (or~3% of the end-of-year post-inflation market cap). Where will they get the money to pay that? Well, they’ll likely have to sell some PIE, putting downward pressure on the price. This is what happens when you effectively have an annual wealth tax on an unproductive asset. Well, how bad is this? It’s only 3.5%, right?

As a thought experiment, let’s assume the IRS decided they’d actually take PIE in payment of taxes, rather than requiring dollars, and they’re willing to just sit on it (and of course stake their own coins too). The below table shows what happens to the ownership base of PIE over time. The tax authorities own over half the coins by year 22. (At least, hopefully, the roads will be nice.)

You can assume whatever you want, your results will differ with each assumption. The question is are your assumptions logical? are they rooted in reality? If not…it’s an exercise in futility.

Cryptocurrencies whether POS or otherwise are decentralized. Decentralized means international, there is no set tax rate, not between countries, tax rates differ from state to state as well. Tax collection agencies can’t enforce anything when it comes to crypto, not in foreseeable future. You would need a KYC for every person who own a coin, which is not gonna happen. Any taxes collected would be volunteered. Cryptocurrencies have internal treasuries and tax structures. The authors scenarios work only in a fairytale Orwellian 1984 world. “The Hunger games” are more plausible that these “let’s for the sake of simplicity assume” scenarios, so I won’t bother going any deeper into them. This article is an exercise in imagination and nothing more. There is nothing scientific in the authors thought process on this discussion. I would categorize this article as click-bate or FUD.

I want to add to your observations by pointing to stocks that don’t pay dividends. Applying the authors hypotheses to those stocks logically makes them negative return instruments - and that is absurd.

Yes, I agree with your assessment that this article is somewhat flawed.

Bitcoin rewards are currently being paid through newly minted coins and therefore causes inflation. So PoS is no different in that sense. However like Bitcoin, it is my understanding that given the finite supply, this won’t last forever and eventually rewards will be paid for by fees.

I also don’t follow the logic that the IRS would hold all coins paid to it. Isn’t the point of taxes by the government to allow them to spend on providing services, which puts the coins back into the system.

It also doesn’t take into consideration the utility value of the coins. At some point the hope is that people will use their crypto to buy goods and services, not just holding onto them for the sake of earning rewards and never actually use them for anything.

Finally, I am not sure about the US, but aren’t taxes only applied when exiting to fiat?

At this point in the US at least staking rewards will be seen as regular income and be taxed at that rate unfortunately. I’d like the various crypto lobbying groups to address that issue with law makers. I believe Arizona had a recent bill that allowed people to pay taxes in crypto, not sure if it passed though. In general the taxes will help distribute Ada into more hands as people sell to pay taxes. Probably a good thing.

Coinbase doesn’t carry ![]() , most people get their

, most people get their ![]() from an exchange that doesn’t report to IRS. They don’t know what people hold unless people volunteer that information. My personal feeling; don’t volunteer that information. The Fed and IRS already hold too much power over our lives with their invisible hand up our ass making us dance like puppets…devaluing our money on one hand then taxing us to death on the other

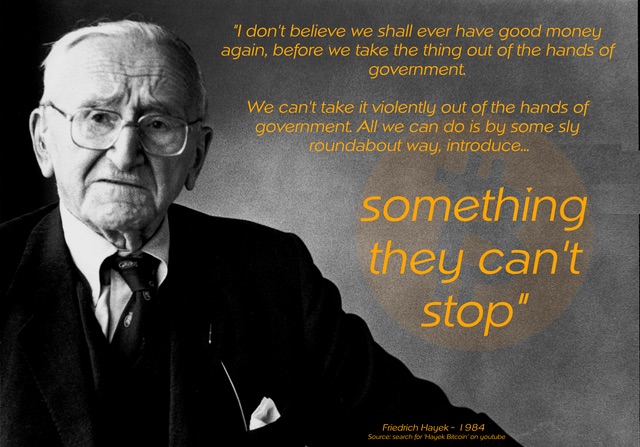

from an exchange that doesn’t report to IRS. They don’t know what people hold unless people volunteer that information. My personal feeling; don’t volunteer that information. The Fed and IRS already hold too much power over our lives with their invisible hand up our ass making us dance like puppets…devaluing our money on one hand then taxing us to death on the other ![]() …committing us to servitude with their universal credit. These are not some holy entities…they’re another set of flawed industries that will get disrupted by blockchain tech.

…committing us to servitude with their universal credit. These are not some holy entities…they’re another set of flawed industries that will get disrupted by blockchain tech.

I am no fan of paying taxes but I have way too much to lose to mess around with the IRS. If ADA becomes as valuable as we all hope you will surely attract attention if/when you ever want to turn it into fiat. Far better to have no worries about going to jail. Cheaper to do it now also because they whack you with major penalties if you are forced to come clean. Don’t forget the blockchain leaves an immutable trail for the feds to follow. That is my opinion.

Well by the looks of things, soon we won’t have to convert them back to FIAT, I wonder how they’ll try to get their hands in our pockets then.

100% agree.The IRS is still getting its footing for Crypto,and when they do watch out.I want all my stuff in order and proof of reporting.When we all start turning heads with crypto profits,their interest will be peaked.Do it right now,so you don’t take a gut shot later.We really need some clear framework from the IRS…Its a real gray area.

See I got a problem with that, laws change all the time…it takes them a while to get things right. Currently IRS taxes capital gains. The IRS treats “virtual currency” as property, which means every trade you complete with cryptoassets is a taxable event. Only in US might I add, name another country that follows this idiocracy. But to try to tax staking rewards, that’s just a whole new level of (and I use this word seriously) stupid. I say wait, let them catch up. You are more or less in a clear as long as you don’t convert your holding to FIAT, it’s much harder to define what’s a “taxable even” beyond that…is sending funds from one of your wallets to another “a taxable event?” ![]() On the second thought

On the second thought ![]() I think currently it might be…

I think currently it might be…

Agreed on all accounts.My opinion vs the IRS guidelines is another account.Its lame and makes no sense, but until other IRS code is implemented,it is what it is.Crypto to fiat should be the ONLY taxable event,but its not.

There is also a paradigm shift going on as well…what if I told you that people shouldn’t be afraid of the IRS…that IRS should be afraid of the people in a system where we pay one third of our measly livelihoods and “Bazos” and “Zuckerberg’s” pay nothing

Comes down to deciding what your going to do in the interim.I’m breaking it down on Risk vs Reward ratios here

yeah, I suppose I just got worked up on the ideological side of things…it just really Grinds my gears. IRS Spun out of control after the Capone arrest…used to be a small little agency, now it’s the big bad wolf…the freedoms we give up

yeah, I suppose I just got worked up on the ideological side of things…it just really Grinds my gears. IRS Spun out of control after the Capone arrest…used to be a small little agency, now it’s the big bad wolf…the freedoms we give up

Truth.On the brighter side of things,I’m only a stones throw away from Wyoming.

IOHK didn’t relocate to Wyoming for no reason at all

@Hindsightistwenty20

, I only wish I could like this twice!

, I only wish I could like this twice!

Is there really that much inflation if transaction fees pay stake rewards?

From Cardano-SL

“ TRANSACTION FEES DISTRIBUTION

All transaction fees of a given epoch are collected in a virtual pool, and the idea is to then redistribute the money from that pool amongst people who were elected slot leaders by the PoS-algorithm during that epoch and who created blocks.”

I believe that will happen once all the coins have been minted. There are 20billion un-minted  that will be used as incentives, so potential for inflation is there. That being said I’m sure the rate of inflation will be tightly controlled and offset by the rising value of the

that will be used as incentives, so potential for inflation is there. That being said I’m sure the rate of inflation will be tightly controlled and offset by the rising value of the  with increased utility.

with increased utility.

So I don’t get this (and I better check what is happening in Australia where I live).

So you are saying that there could be a scenario where if you earn additional coins (through staking), but the total value of all your coins against fiat goes down (market forces), that you still have to pay tax on the additional coins?

e.g.

Pre-epoch - 100 ADA @ $0.1/ADA = $10 total value

Post-epoch - 105 ADA @ $0.08/ADA = $8.40 total value

If so, then that is pretty messed up.

Plus, if they are just going to tax you in the cryptocurrency (rather than fiat), then how are they going to manage the thousands of tokens that will exist. It will be a logistical nightmare, costing them heaps to maintain access to different blockchain so they can receive tax payments.